News

A Shady Scam Is Targeting College Kids And Parents. Here’s How To Spot It.

As a student or the parent of one, the cost of tuition is always at the back of your mind.

The average price of attending a four-year college nowadays ranges from $108,584 at public institutions to over $234,512 at private universities, according to the Education Data Initiative. And as schools go back in session, scammers prey on family’s financial anxieties.

The Federal Communications Commission issued an alert this spring to students and parents, warning them to be wary of “scammers seeking to capitalize on the busy academic season, online as well as over the phone.” One of the top student scams the FCC says to be wary of? The scholarship scam.

Michael Jabbara, the vice president and global head of fraud services for Visa, said the credit card company is seeing an uptick in these tuition-related scams.

In these tricks, families will typically receive a tempting email that redirects them to a website promising, “Hey, we can offer you scholarships or discounts to pay your tuition. All you have to do is complete your application and pay a processing fee,” Jabbara explained. “And sometimes it is about getting the money. Sometimes it’s about stealing that sensitive data so that it can be monetized elsewhere.”

These bad actors will sometimes claim to be reaching out under the authority of an altruistic organization, a school’s financial aid office or a well-known celebrity. In 2014, filmmaker Tyler Perry warned fans about a fake scholarship program using his name: “Do not let anyone tell you that I have a scholarship program that you have to pay to be a part of, ok? That’s NOT TRUE!” he wrote on Facebook.

Jabbara said the scholarship scams can be so effective because they play into people’s anxiety of whether students can afford their dream school or if parents can pay for their child’s education.

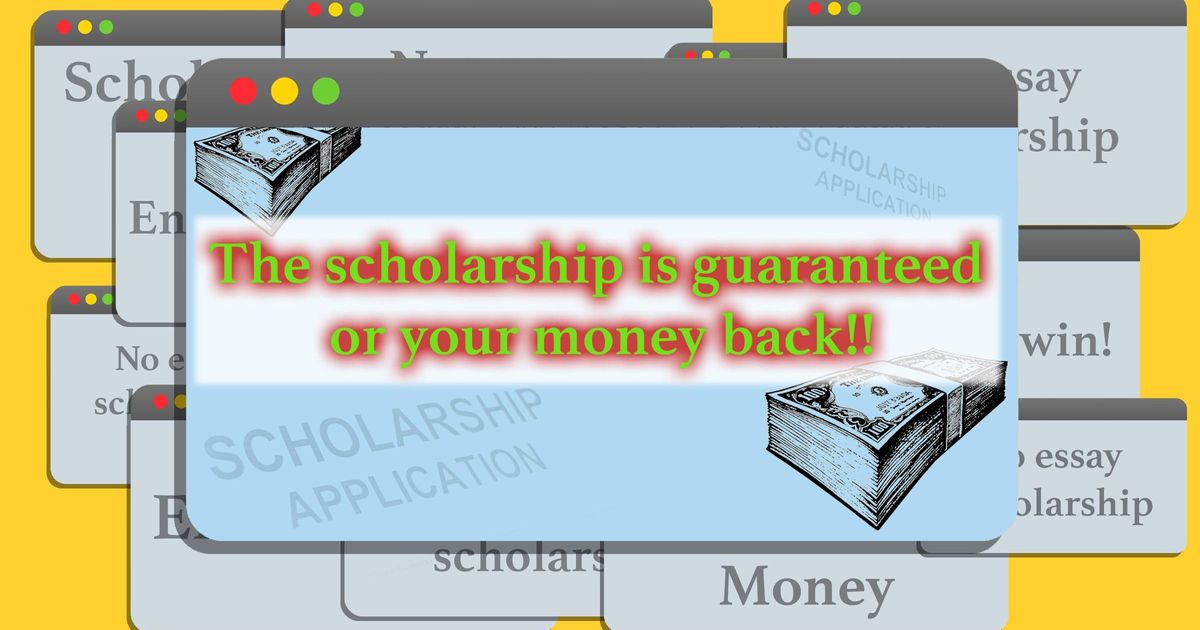

The Biggest Red Flags Of A Scholarship Scam

There are many legitimate scholarships that will help cover the costs of college, but be wary of organizations that overpromise what they can do for you, Jabbara said.

If “all you have to do is apply and you’re automatically guaranteed to get an offer, or if you use [that] service, you’ll be able to get 80% discount on your tuition fees,” that’s likely a scam, he said. As with other scams, being asked to pay through a wire transfer or a peer-to-peer app like Venmo is also a sign you’re being scammed, Jabbara added.

Be wary of scholarships that ask you to pay fees before applying, too. It’s normal to pay to become a member of an organization that offers scholarships like the National Parent Teacher Association, but it’s not normal to be paying application fees, said Jocelyn Pearson, the CEO and founder of The Scholarship System, a company that helps people secure college scholarships.

“If it’s a scholarship that specifically requires a fee to submit it, don’t do it,” she said.

It also helps to understand what a scholarship typically will ask to know from applicants. Your name, birthday, age, grade, school, address, where you plan to go to school, contact information, testing scores, or your Student Aid Index ― a formula-based index number that determines how much financial support you need for college ― are “fair game” questions, Pearson said. But it’s a big red flag if the scholarship wants your social security number. “That’s definitely a scam,” she said.

What To Do If You Fall Victim To A Scholarship Scam

The best way to combat a scholarship scam is to avoid applying to them in the first place. But if you already submitted your information to a scholarship that you suspect is fraudulent, there are still a few things you can do:

Report what happened to authorities.

“Call your bank and let them know that you’ve been the victim of fraud, so that it gets flagged in the system and you’ll be able to dispute that,” Jabbara recommended.

If you paid the scam through a peer-to-peer app or using cash, your options for recourse might be limited. But even if you are not able to recover your money, reporting it to your local or federal authorities can help alert them to rising trends. You can file a complaint with the Federal Trade Commission online or by calling 877-382-4357.

Double-check the track record of who is paying out the scholarship.

If someone is claiming to be from a college’s financial aid office, look up the number on the school’s website before you call them, and do not use the number you see in an email, said Melanie McGovern, the director of public relations and social media for the Better Business Bureau.

“If you get that email or you see an ad, go over to a search engine, type it in and use the word ‘scam,’ ‘fraud,’ or reviews to see what people are saying,” McGovern recommended.

Go to your school’s college counselor for help with finding real scholarships, and if you do not have one, use a trusted database. Pearson recommended websites like Broke Scholar and Scholly that have search filters, as well as JLV College Counseling’s list, which was created by a former college admissions counselor and “has huge lists of legitimate scholarships.” She also recommended RaiseMe, which enables students to earn scholarship money based on certain academic and extracurricular activities they do throughout high school.

Finding scholarships can be overwhelming, so if you’re a parent wondering how to help your student, Pearson said that “building the list of scholarships that they’re applying to is one of the best ways you can help.”

Create a separate email for the scholarship process.

Whether it’s a scam or not, it’s helpful to limit what information you give out in case you accidentally apply to a fraudulent scholarship.

Take it from Pearson, who used her personal email address back when she was applying for scholarships that turned out to be scams: “That email address that I used back then is completely destroyed. It had well over 20,000 unread emails, because I was getting spammed daily from these companies.“

That’s why she recommends creating an email address specifically for scholarships like jocelynscholarships@gmail.com.

Target scholarships that have a more thorough application process instead.

When Pearson was a high school junior, she wasted a year applying to dozens of sweepstakes scholarships that used language like “no-essay scholarship,” “enter to win” or had “monthly drawings” for rewards. These lottery-based scholarships are not necessarily fraudulent, but Pearson considers them to be a scam since your chances of winning are “very slim,” she said.

“Most families have done these at some point, including myself, because they’re quick and easy,” she said. “So if it takes a student 15 minutes or less to knock out an application, that’s also a warning sign right there, because then it’s just not based on [their] credentials.”

Instead of wasting time on these luck-based scholarships, Pearson recommends targeting ones that are more involved with essays and interviews. That’s what Pearson did after her disappointing junior year and won over $126,000 in scholarship money to pay for her college ― and she had money left over.

The good news is that the best time to apply and win a scholarship might be around the corner, Pearson said. The “true scholarship season” is January through May, so fall is a less competitive time where students have a greater chance of winning, she said.

Applying for a legitimate scholarship takes time, but it’s worth it. After you learn how to properly apply for scholarships, it’s a skill you can benefit from throughout your college experience.

“Once they can figure out legitimate scholarships versus scams, they can apply junior year in high school, senior year in high school, and all four years of college, like I did,” Pearson said.

Read more